Transformational Quantitative Analytics, Research & Trading Talent

Quants are highly sought after in finance due to their ability to turn complex data into profitable strategies. Investment banks, hedge funds, and fintechs rely on their advanced math and programming skills to drive high-stakes decisions in trading, risk management, and portfolio optimization, giving firms a crucial edge over competitors.

Businesses looking to attract this elite talent need a specialist partner with over 20 years of experience – let Selby Jennings source the top talent so your firm can make fast, accurate, and profitable decisions.

Quantitative analytics, research & trading talent services, bespoke to you

Hiring for your business

As a leader in quants recruitment, Selby Jennings specializes in placing niche, hard-to-find quants professionals through several talent solutions, tailored to your organization's unique needs.

Looking for a new role?

Considering a career move? Selby Jennings connects you with new opportunities that match your personal and professional goals, supporting you throughout the hiring process.

Enhancing & adding value

We make it our business to offer you more than quants recruitment. Discover the value-added services we provide that help you to make hiring or career decisions with confidence.

Securing tomorrow's talent

Selby Jennings’ unparalleled market knowledge and quantitative analytics, research & trading recruitment expertise ensures we can source top quantitative finance talent with the advanced skills needed for industry-leading firms. From international investment banks and boutique hedge funds to management consultancies and software providers, we service a wide range of clientele.

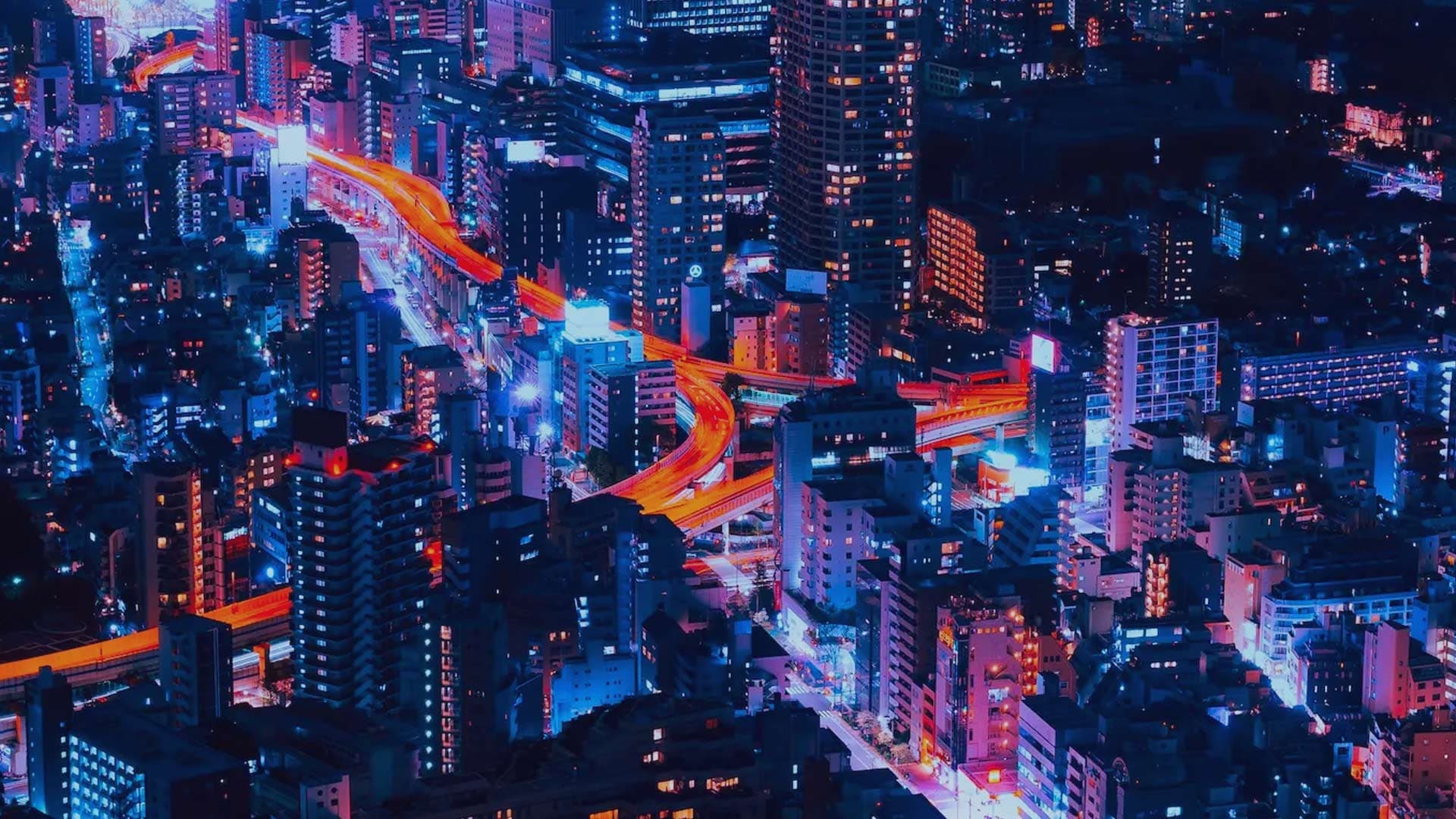

With a strong market presence in key financial hubs around the world, you can rely on our expertise and extensive candidate network to deliver professionals who excel in data-driven decision-making, risk management, and financial engineering.

Our tailored quants recruitment services have led to successful placements across financial hubs worldwide.

0+

quant placements in 2024

0

weeks to secure talent

Discover key markets and the types of companies we support here:

- Investment Banks

- Hedge Funds

- Proprietary Trading Firms

- Asset Managers

- Financial Technology Institutions

- Quantitative Researchers (Equity, FI, Macro, Commodities, Crypto)

- Quantitative Traders (HFT, Equities, FI, Crypto, Commodities)

- Quantitative Analysts (Derivatives Pricing, eFX, Algo/MM)

- Quantitative Developers

- C-Level Quantitative Strategy

- Portfolio Managers (Systematic Equities, Systematic Macro,

Systematic Commodities, Crypto)

CLIENT TESTIMONIALS

Quantitative analytics, research & trading jobs you need to know about

We connect top talent with the right roles. Explore our latest opportunities across the globe in quantitative analysis, portfolio management, software development, quantitative trading, C-level quant strategy, quantitative research, and more.

Looking to hire?

Discuss your hiring needs and get a tailored plan to source top quantitative analytics, research and trading talent quickly and accurately.

Looking for a new role?

Discover industry-leading opportunities, from proprietary trading firms through to investment banks. Find your next quants role today.

Explore our financial sciences & services expertise

Securing exceptional talent can be difficult and time-consuming without the right talent partner who understands your market. That’s why we have consultants dedicated to the following specialisms: