Why Compliance Talent Matters

Demand for compliance professionals is growing significantly due to increasing regulatory scrutiny, financial crime risks, and the complexities of global legislation. Financial institutions must navigate stricter rules like anti-money laundering (AML), KYC, and data protection to avoid penalties and safeguard operations.

At Selby Jennings, we source top compliance talent from around the globe to help your firm effectively manage these challenges.

Compliance talent services, bespoke to you

Hiring for your business

As a leader in compliance recruitment, Selby Jennings specializes in placing niche, hard-to-find compliance professionals through several talent solutions, tailored to your organization's unique needs.

Looking for a new role?

Considering a career move? Explore compliance jobs with Selby Jennings, where we connect you with new opportunities that match your personal and professional goals, supporting you throughout the hiring process.

Enhancing & adding value

We make it our business to offer you more than compliance recruitment. Discover the value-added services we provide that help you to make hiring or career decisions with confidence.

Securing tomorrow's talent

Whether you need a Head of Compliance, MLRO, Head of Anti-Money Laundering, or Financial Crime Officer, we understand the critical need for compliance roles in today’s financial services environment across corporate banks, asset managers, hedge funds, private banking, and insurance companies.

With expertise in sectors such as private banking, brokerages, and HFT, Selby Jennings ensures you secure the compliance talent you need to stay ahead, mitigate risks, and safeguard your reputation for the long term.

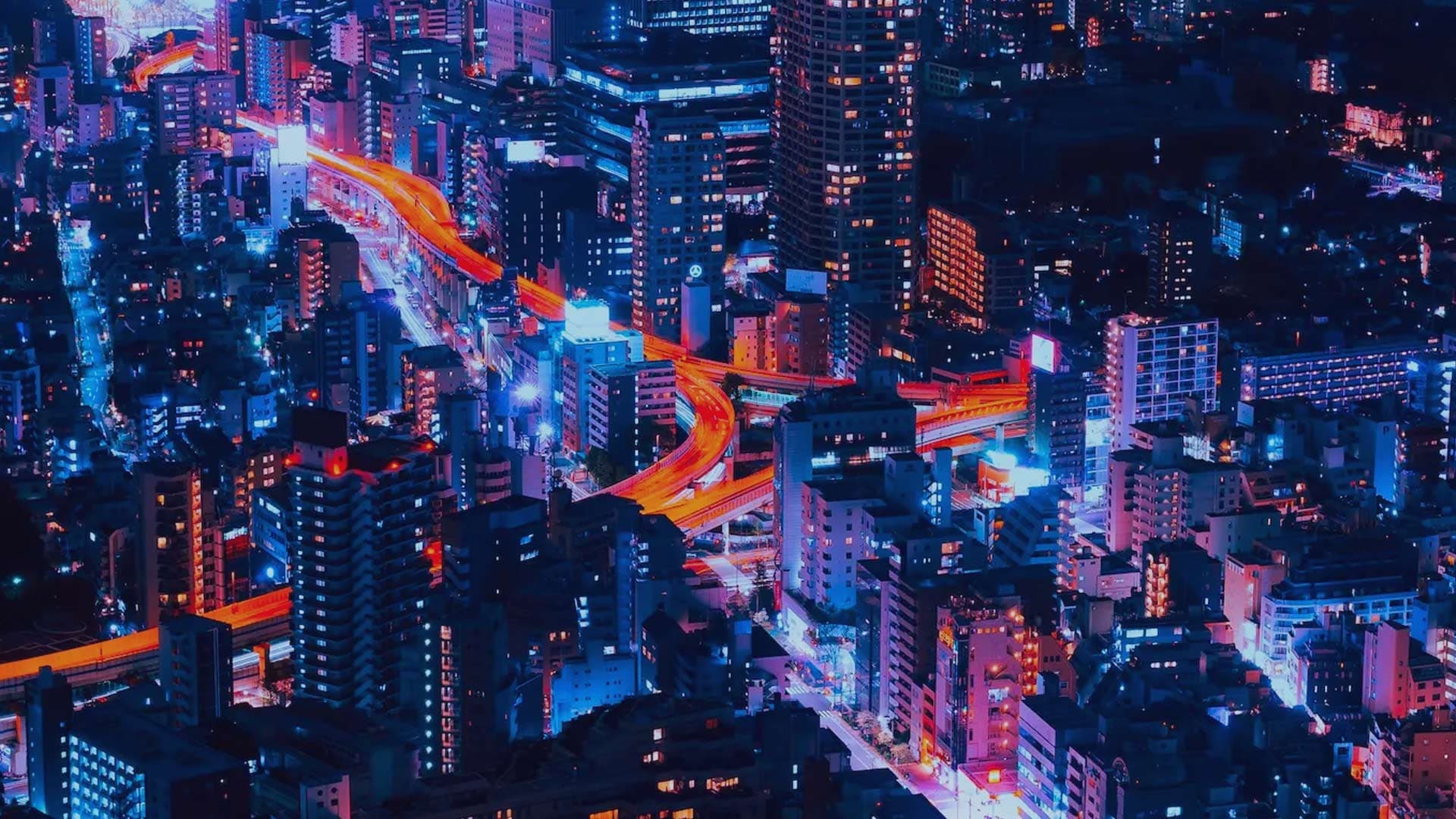

Our tailored compliance recruitment services have led to successful placements across financial hubs worldwide.

Discover key roles and the types of companies we support here:

- Corporate, Investment & Retail Banks

- Private Banking & Wealth Management Companies

- Asset Managers & Hedge Funds

- Trust & Fiduciaries

- Brokerages & Clearing Houses

- Insurance Companies

- HFT & Proprietary Trading

- Head of Compliance

- MLRO

- Head of Anti-Money Laundering

- Head of Financial Crime

- Compliance Officer

- Financial Crime Officer

CLIENT TESTIMONIALS

Looking to hire?

Discuss your hiring needs and get a tailored plan to source top compliance talent quickly and accurately.

Looking for a new role?

Bringing you the latest industry-leading opportunities that leverage your compliance expertise, find your next career-defining role through Selby Jennings today.

Explore our financial sciences & services expertise

Securing exceptional talent can be difficult and time-consuming without the right talent partner who understands your market. That’s why we have consultants dedicated to the following specialisms: