Driving Success with Wealth Management Experts

As the number of high-net-worth individuals (HNWIs) continues to grow, so does the demand for expert guidance on personalized financial planning, investment strategies, and retirement solutions. This puts increased pressure on financial institutions to attract top talent with niche skills to cater to diverse client needs and evolving financial regulations.

Working with a talent partner like Selby Jennings, who understands the unique skills and expertise required in wealth management, investment management, tax planning, and digital client engagement has become essential for businesses aiming to meet the needs of HNWIs.

Wealth management talent services, bespoke to you

Hiring for your business

As a leader in wealth management recruitment, Selby Jennings specializes in placing niche, hard-to-find wealth management professionals through several talent solutions, tailored to your organization's unique needs.

Looking for a new role?

Considering a career move? Selby Jennings connects you with new opportunities that match your personal and professional goals, supporting you throughout the hiring process.

Enhancing & adding value

We make it our business to offer you more than wealth management recruitment. Discover the value-added services we provide that help you to make hiring or career decisions with confidence.

Securing tomorrow's talent

Wealth management roles are highly particular, with professionals needing comprehensive experience in investment management, tax, regulatory compliance, and relationship management. As client expectations grow for bespoke, technology-driven services, demand for professionals with the right expertise and skills is higher than ever.

Selby Jennings boasts a global talent pool of wealth management candidates enabling us to connect businesses with top talent quickly, reducing the time-to-hire for critical roles. These candidates will help you drive client satisfaction, foster growth and support long-term success.

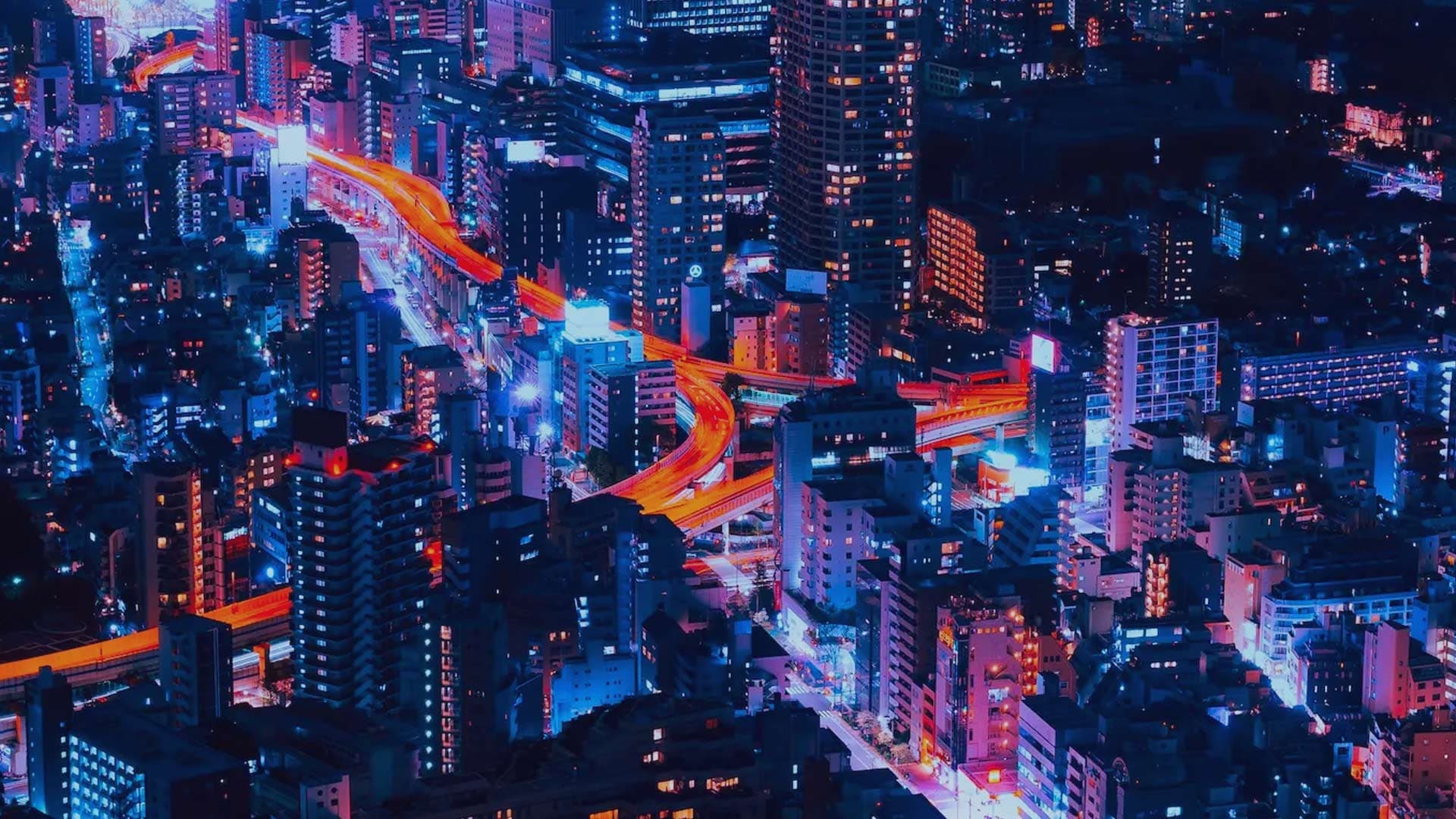

Our tailored wealth management recruitment services have led to successful placements across financial hubs worldwide.

- Universal Banks

- Pure-Play Private Banks

- Swiss Boutique Banks

- Large External Asset Managers

- Multi- & Single-Family Offices

- Managing Directors

- Head of Private Banking

- Team Heads / Market Heads

- Senior / Junior Private Bankers

- Investment Advisers

- Portfolio Managers Private Banking

TESTIMONIALS

Looking to hire?

Discuss your hiring needs and get a tailored plan to source top wealth management talent quickly and accurately.

Looking for a new role?

Working with organizations from single and multi-family offices through to universal banks, find your next role in wealth management today.

Explore our financial sciences & services expertise

Securing exceptional talent can be difficult and time-consuming without the right talent partner who understands your market. That’s why we have consultants dedicated to the following specialisms: