Essential Investment Management Talent

Investment management professionals are in high demand as the global asset management market is projected to reach $145 trillion by 2025. As investors seek more complex financial strategies, investment managers are essential for navigating volatility, optimizing returns, and mitigating risk.

As businesses adapt to market shifts and regulatory changes, the need for experienced investment management professionals continues to grow, making them crucial for organizations aiming to stay competitive and achieve long-term financial success. Partner with Selby Jennings, a leader in investment management recruitment, to secure top talent.

Investment management talent services, bespoke to you

Hiring for your business

Selby Jennings specializes investment management recruitment, placing niche, hard-to-find investment management professionals through several talent solutions, tailored to your organization's unique needs.

Looking for a new role?

Considering a career move? Explore our global investment management jobs and receive support throughout the hiring process.

Enhancing & adding value

We make it our business to offer you more than investment management recruitment. Discover the value-added services we provide that help you to make hiring or career decisions with confidence.

Securing tomorrow's talent

Finding high-caliber investment management professionals is becoming increasingly difficult in today’s competitive hiring climate. With the support of Selby Jennings, we’ll make sure you act quickly, helping you to hire and retain the top investment management teams.

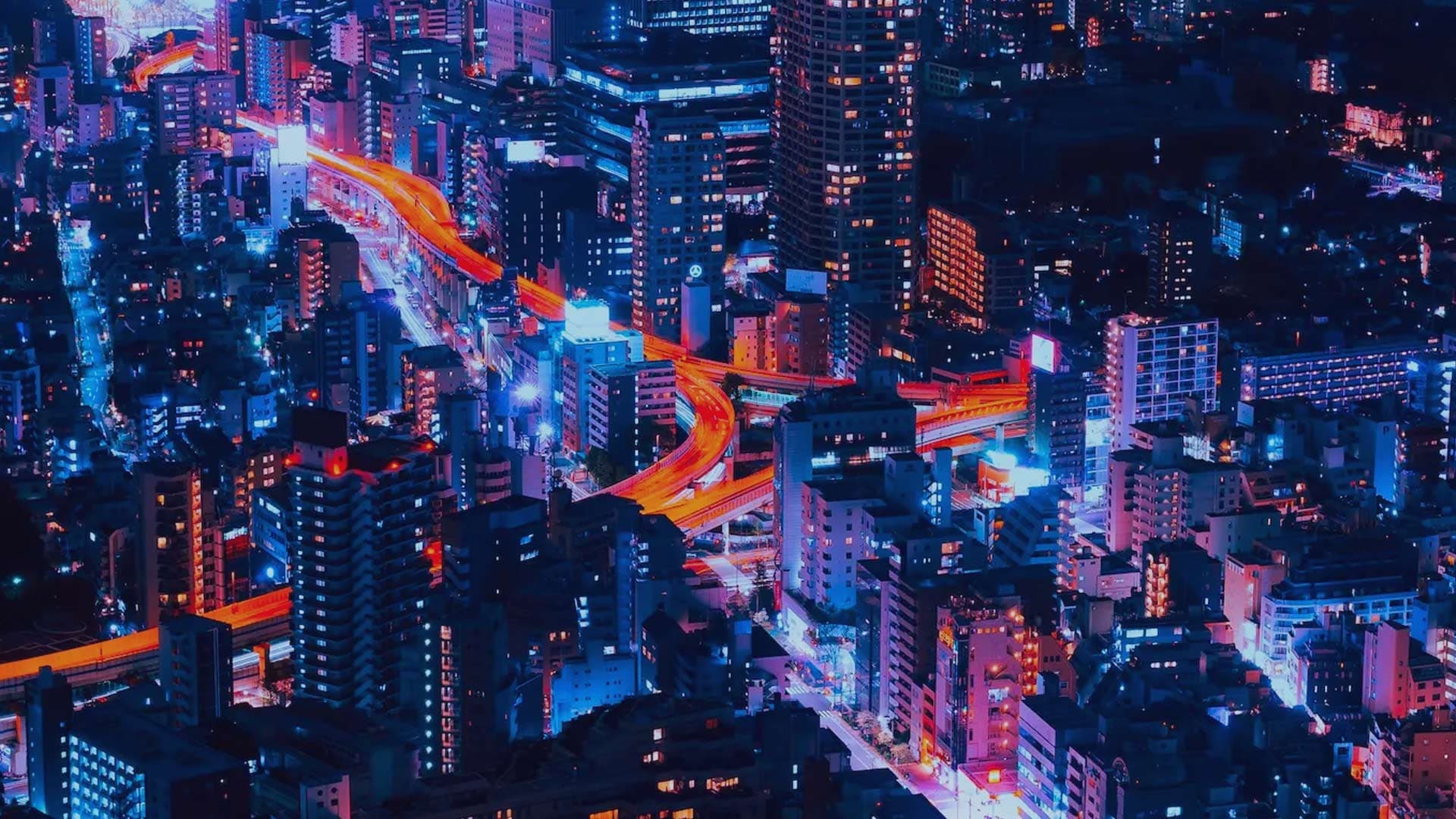

With a presence in key financial hubs, and experience working with companies ranging from boutique asset managers to large investment firms, you can rely on our expertise and extensive candidate network to meet your talent requirements.

Our tailored investment management recruitment services have led to successful placements across financial hubs worldwide.

- Private Markets

Private credit, real assets, private equity, and

venture capital investment mandates across

direct, co-investments & secondaries - Public Markets

Equity, fixed income, credit, macro, event-driven

investment mandates, across both traditional

and hedge fund strategies - Business Development & Investor Relations

Cover all client facing, and client support

mandates across all asset classes

- Asset Management Companies

- Private Equity Firms

- Hedge Funds

- Banks

- Insurance Firms

- Pension & Sovereign Wealth Funds

- Family Offices

- Public Market Investment Professionals

Portfolio & Fund Managers, Traders, Research Analysts - Private Market Investment Professionals

Transactions, Portfolio Monitoring, Asset Management,

Origination - Asset Raising & Investor Relations

- C-Level Positions

CLIENT TESTIMONIALS

Looking to hire?

Discuss your hiring needs and get a tailored plan to source top investment management talent quickly and accurately.

Looking for a new role?

Working with organizations from banks and hedge funds to private equity firms and family offices, find your next career-defining role in investment management.

Explore our financial sciences & services expertise

Securing exceptional talent can be difficult and time-consuming without the right talent partner who understands your market. That’s why we have consultants dedicated to the following specialisms: